More priority needed for the property industry stakeholders

Future FMCOs should consider people’s housing needs

By Joseph Wong josephwong@thestar.com.my

One difficult lesson learned from the most recent full movement control order (FMCO) is that many stakeholders for the property industry had their hands tied up, pushing back deadlines and creating a massive backlog of work that has disrupted the industry further.

This is because work conducted by real estate consultants and valuers were not considered as essential services by the International Trade and Industry Ministry (Miti) despite that having a home is a basic necessity. And considering that valuation is a crucial part in the process of financing loans to homebuyers, this indirectly helps to slow the property market further.

According to the Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector, Malaysia (PEPS), the backlog of reports that valuers need to prepare had stacked up during the FMCO. It estimated that about RM15bil worth of backlog cases was waiting for complete valuation reports to be handed in for loans to be approved and disbursed.

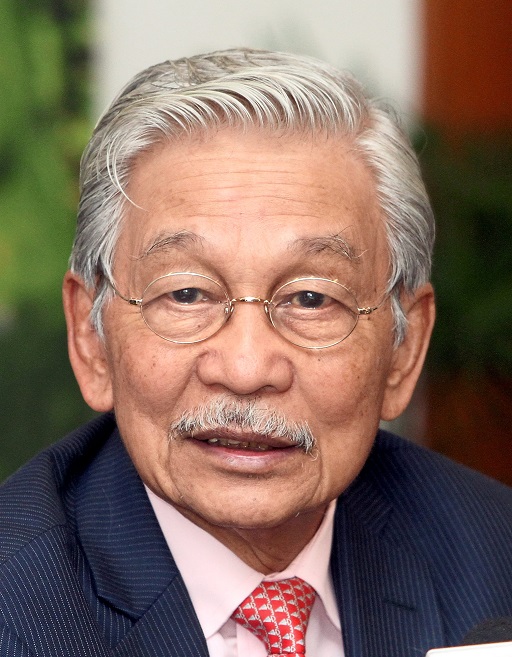

“While banks were open for business, property consultants and valuers were not allowed,” said global real estate consultancy Rahim & Co International Sdn Bhd executive chairman Tan Sri Abdul Rahim.

“Just take my firm as an example. We have six branches in the Klang Valley. We have more than 1,000 cases from banks to value the properties before they can consider the loans. If we take the whole country, the figure would be much higher as I have 23 branches and that’s just one firm. In this country, there are 536 firms. “Imagine the number of cases from banks that cannot be carried out because we are not allowed to be open, and this affects all the stakeholders linked to the financing of home loans,” he lamented.

While the main concern is towards the health and safety of the people, this must be balanced with the opening of the economy and the fact that people require a roof over their heads. And with the number of Covid-19 cases remaining high, another FMCO could be a possibility.

If this reoccurs, Miti needs to give consideration to the real estate consultants and valuers to ensure that buyers are able to secure their loans and gain a home to live in. Abdul Rahim said the minimal number of staff needed for his firm to perform the valuation tasks is about 30%, much lower than the FMCO’s 50% issued during the FMCO.

The bulk of staff members can still function by working from home but with the 30% of employees looking into the valuation for the banks, the backlogs could be cleared up speedily, he said. He said that site inspection visits usually involve one person who goes to a site, and an experienced valuer can do a home inspection in about 15 minutes, depending on the size of the premises.

While banks were open for business, property consultants and valuers were not allowed, said

Abdul Rahim.

Looking forward, Adbul Rahim predicted that the amount of work would likely increase due to the pent up demand for properties that potential buyers were eyeing during the FMCO period. With phase three of the recovery plan in tow, enterprises should see an increase in business activities, which will have a multiplier effect on the economy.

There would be a spillover effect on properties linked to the logistic companies that have seen a boom in business during the pandemic due to the increased number of online shopping and food delivery demands. On the outlook of the property industry, he said it should improve but not to the extent that some stakeholders hope for.

In all likelihood, the property transactions performance will repeat that of the second half of 2020 (2H 2021) after last year’s lockdown due to the build up of pent-up demand. “We expect the low interest rates, the Home Ownership Campaign (HOC) and the RPGT (Real Property Gains Tax) exemption initiative by the government which is extended to Dec 31, 2021 will help spur the property sector.

“However, there will be a mixed performance in the different segments of the property market as the market is more cautious given the high number of Covid-19 cases,” he said. Property developers are also more optimistic about the outlook for the property industry in 2H 2021 than in 1H 2021 as they expect the economy to recover, which will boost the buying sentiment.

In a survey conducted by the Real Estate and Housing Developers’ Association (Rehda) Malaysia, 20% and 26% of the 134 respondents were optimistic about the property market/ sales performance and residential sector growth respectively in 2H 2021, compared with only 8% for both in 1H 2021.

In a survey conducted by the Real Estate and Housing Developers’ Association (Rehda) Malaysia, 20% and 26% of the 134 respondents were optimistic about the property market/ sales performance and residential sector growth respectively in 2H 2021, compared with only 8% for both in 1H 2021.

The survey showed that a total of 13,037 units had been planned for launch in 1H 2021, comprising 12,874 residential units and 163 commercial units. About 80% of the 13,037 properties launched were priced from RM250,001 to RM700,000 as developers were aware of buyers’ affordability issues.

In comparison, 12,640 residential units were launched in 2H 2020 while in 2H 2019, 12,556 units were launched. In terms of unsold units, the survey showed that 64% and 33% of the respondents had unsold residential and commercial units respectively in 2H2020 compared with 71% and 42% in 2H2019. Some 51% of respondents indicated that the overall cost of doing business had increased by 12% in 2H2020. About 98% of them had been affected by the economic situation, while those that were highly and severely affected increased to 42% from 26% in 2H 2019.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.