Too many cooks may spoil the soup

There’s a danger that affordable homes could be the next big overhang if overbuilt

By Joseph Wong josephwong@thestar.com.my

Vigneswar Rajasurian vignes@thestar.com.my

Viktor Chong viktorchong@thestar.com.my

Is this what the future will look like? An overbuilt of high-rise residential property?

Like the proverbial adage of having too many cooks spoiling the soup, the rush to build too many affordable homes in Malaysia without knowing what the actual demand is might serve to create the next big overhang.

This could cause the next critical glut as the lack of coordination among the state and federal agencies, and property developers have triggered worries of overbuilding and further dampened the recovery of the already reeling housing sector.

“Whenever there is too much of something over and above what is needed, an imbalance occurs. That has been so for the overhang situation right now where units are unsold due to either a pricing mismatch, a location mismatch or a product mismatch.

“The lack of real-time and transparent data also complicates the decision making for new projects. With regards to the affordable homes segment, a pertinent factor is the interpretation or definition of an affordable home,” said Rahim & Co International Sdn Bhd executive chairman Tan Sri Abdul Rahim Abdul Rahman. Presently, various parties are involved in the construction of affordable homes which could ruin the overall supply in this segment.

Impending danger

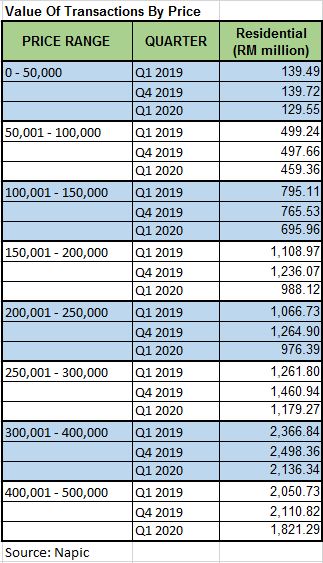

Figures are already pointing to this impending danger as the unsold residential properties have risen in the first six months of this year, with condominium and apartment units priced between RM200,000 and RM300,000 accounted for a large portion of the unsold units. The National Property Information Centre (Napic) figures showed that the transacted figures for both volume and value for residential units priced RM500,000 and below for the Q1 2020 has dropped.

The most affected category is the high-rise residential property, said Kong.

This is compared to the corresponding period of Q1 2019 as well as the Q4 2019 figures (see tables 1 and 2). All eight sub-categories saw a drop in both volume and value transactions for Q1 2020 when compared to both Q1 2019 and Q4 2019 figures. The sub-categories are as listed below:

| Below RM50,000 |

| RM50,001 to RM100,000 |

| RM100,001 to RM150,000 |

| RM150,001 to RM200,000 |

| RM200,001 to RM250,000 |

| RM250,001 to RM300,000 |

| RM300,001 to RM400,000 |

| RM400,001 to RM500,000 |

The RM150,001 to RM200,000 sub-category saw the highest difference in volume transactions with 1,401 units separating the Q1 2019 figures to the Q1 2020 ones. In transacted value, the RM300,001 to RM400,000 sub-category saw the highest difference of over RM362mil for Q1 2020 versus the corresponding period of 2019.

What is scary to contemplate is the government’s enthusiasm to target the construction of one million affordable homes within 10 years. The current approach to affordable housing has been to build more public housing through government agencies as well as to impose quotas that require developers to build low-cost housing.

The Napic figures clearly indicate that the building of more affordable homes indiscriminately is not the way forward. There is obviously a mismatch between the demand for affordable homes versus the ones being supplied in the market.

One of the issues is that the state and federal agencies, as well as developers, appear to be developing affordable homes just for the sake of hitting the one million target. How many are considering or researching into what the potential homebuyers want?

Too many agencies

According to the Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector Malaysia (PEPS), there are about 20 national and state agencies involved in providing affordable housing. While the Ministry of Housing and Local Government (KPKT) have been making efforts to bring all the housing agencies to come under one roof, this has only been partially achieved as some agencies were determined to remain independent of KPKT. Hence, a more comprehensive solution has yet to be found.

“At present, some factions have started to recognise location as a factor in determining how affordable a product is, but many still rely mainly on the price tag as the key determinant of being affordable. It should comprise the elements of product type, comfort, size and build quality,” said Rahim.

“Should the incoming supply of affordable homes comply with each of these aspects – they should be taken up by the market. But there is also the risk of volume mismatch.

“Affordable properties that match the price, location and product needs of one particular buyer segment, can still suffer from overhang if there are too much of it for the geographical area’s population size.

Whenever there is too much of what is needed, an imbalance occurs. said Rahim.

“It can match the price (being affordably priced to the targeted buyers of a certain income group), match the location (being at the right location with good transport linkages, amenities, facilities and neighbourhood) and match the product (being the right type, the right concept and the right size) but you may have too many affordable units being built – due to poor coordination – in an area with a smaller number of buyers where only a portion of them are able to get financing to buy the property,” he said.

Like many property stakeholders, Kith and Kin Realty Sdn Bhd senior real estate negotiator Joseph Chan is fearful that more affordable homes will definitely worsen the property overhang as the demand to purchase has dropped due to the Covid-19 pandemic.

“As there are many unsold completed units in the market, adding more supply of new affordable homes will definitely make it more difficult to sell. In fact, affordable homes will also face difficulty in selling because developers are now giving out many attractive packages and incentives to the purchase.

“Recently we have seen the developers launching the property at much lower price with better facilities and environment which are comparable to affordable homes,” he said.

No increase in demand

White Knights Real Estate Sdn Bhd senior real estate negotiator Junnes Cheng is one of those front-liners who is seeing this dire potential situation. When asked if there has been an increase in demand to purchase affordable homes and she replied “no”.

The same scenario applies to the rental market. Cheng also notes that there has not been an increase in demand to rent affordable homes. “Owners have been challenged with rental prices, because of Covid-19,” she said, noting that tenants would have a choice of lower rents currently.

Among the reasons why tenants tend to keep away from affordable homes include poor maintenance, social ills, security issues and insufficient parking allocations. A lower demand for affordable housing is just one part of the issue. The problem is that there has been a drop in demand across the board.

This, in effect, has led to property prices dropping across the board. The affordable homes are mainly targeted for the B40 and partially M40 income earners, injected Chan.

Chan said the demand to purchase has dropped due to the pandemic.

“The global pandemic has affected the incomes of these categories of buyers which has resulted in the demand for purchase of affordable homes reduced. Many of them have experienced job losses or salary cuts, and we have seen the government introducing several initiatives to ease the burden of the affected citizens, for example, Prihatin.

“We have also seen the government reintroduce the Home Ownership Campaign (HOC) to revive the property market . The HOC will allow buyers to own the property at minimal down payment and developers are also providing additional incentives like furnishing to attract the buyers.

“Apart from that, the Bank Negara has also reduced the Overnight Policy Rate (OPR) four time this year, which is a sign of softening market. The above announcement is a sign of low demand, hence the initiative is introduced to encourage the buyers to purchase affordable homes.” he said.

For Chan, he found that there was an increase in demand for home rentals below the RM1,500 mark. “During the downturn economy, many people are looking to reduce their expenses by renting affordable homes. When the market is soft, the rental property market will thrive because rental property is the cheapest option of moving in.

“Many home buyers are holding back their purchase because of the uncertainty and do not have sufficient funds to purchase. I believe the owners are able to rent out the affordable homes because there are demands. Besides that, some of the owners are aware of the situation, they have reduced the rental because their mortgage interest rate has reduced as well,” he reasoned.

Overbuilt in the wrong location

The most affected category is the high-rise residential property, according to PEPS president Michael Kong. The reason for this? “Overbuilt,” he said.

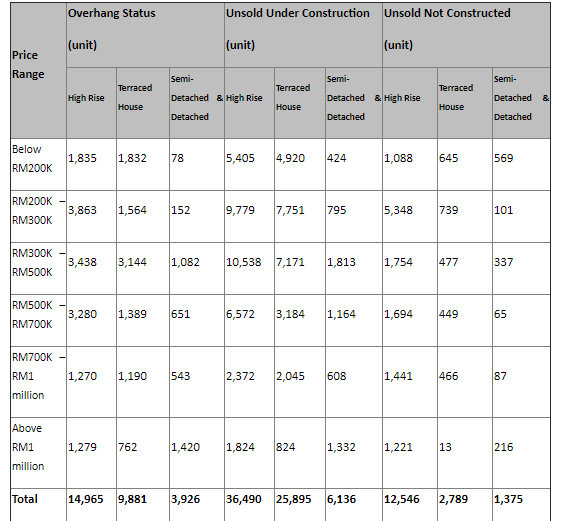

As per the Table 3 statistics, there is no lack of affordable housing, but the main issue appears to be one that is linked to location, said Kong. Location, being one of the most potent mantras where property is concerned, appears to be a fallacy that many developers and the government agencies are continuing to ignore.

“The question is, where? The mismatch currently is due to rampant construction of housing, be it affordable or not in an undesirable location without infrastructural support, connectivity and job opportunity,” said Kong. Like Rahim, he also questioned what affordability really means: “What is the measurement of affordability? Price reference alone is too simplistic and may not be a good index. We need to consider various other factors such as location, connectivity and accessibility, and job opportunities.”

It leaves little imagination as to why many government agencies and developers have been blamed for the construction of low-cost housing in remote places or places that lack connectivity, subsequently attracting poor take-up. PEPS have long challenged that research should be carried out on supply and demand, income levels, household incomes, affordability and pricing issues, and buyer preferences to capture effective demand.

There has been no increase in demand to purchase affordable homes, said Cheng.

The trick is to get developers to allocate a certain percentage of their townships for affordable housing and to jointly develop with the corporation. According to PEPS, based on the data by the Valuation and Property Services Department of Malaysia, the house price median in the country stands at RM280,000.

The house price median is at RM500,000 in Kuala Lumpur and for Selangor, it is at RM380,000 as in the first half of 2019. The housing price median has increased by 77.21% since 2010 in Malaysia. According to Khazanah Research, the affordable market should have a median multiple of three times the annual household income. But based on the current household income, most Malaysians will not be able to afford a house.

Given this formula, the affordable housing prices based on current household income should be RM188,000 in the country, compared to the current median house price of RM280,000. KL’s affordable home price tag should be RM327,000 given the higher household income, but it also falls short of the current median house price of RM500,000 in the city limits.

In comparison, Selangor also isn’t better off at RM260,000 versus the current RM380,000. But again, Kong reminds that the location will be the determining factor whether an overbuilt of affordable homes will trigger an overhang for this category. In short, the industry needs to have better and more effective coordination and cooperation, both intra- and inter-public and private sectors, as well as a robust data resource to be able to keep the situation under control not just for now but also to allow better decisions and approval processes for years to come, Rahim said. Only then can the affordable segment move in tandem with the actual demand for such housing.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.